A Brief History

Most of us instantly recognize the word ‘’Neon’’ when we hear it, but what is neon? Neon (Greek form meaning ‘’New’’) is a naturally occurring inert gas that was first discovered in 1898 by two chemists— Scottish chemist Sir William Ramsay and English chemist Morris Travers. It is part of the periodic table of elements and is considered a rare or “noble” gas.

Researchers soon discovered that neon gives off a reddish–orange glow when used in a high-voltage discharge tube. However, neon’s scarcity precluded its prompt application for commercial lighting in the early 1900s.

Through the efforts of a man named Georges Claude we were soon able to produce industrial quantities of neon—as a byproduct of Claude’s air liquefaction business. In 1910 Claude demonstrated modern neon lighting by using a sealed tube of neon. Soon Claude and his associates began selling neon discharge tubes as a medium for creating advertising signs. The glow and arresting red color made neon advertising completely different from the competition of the day. Neon was introduced to the U.S. in 1923, when two large neon signs were bought by a Los Angeles-based Packard auto dealership.

Later the term Neon grew to encompass all high-voltage discharge tubes. Although still referred to as “neon,” a number of other inert rare gases were being used in neon lighting applications to achieve varied colors, and fluorescent phosphors were used as a coating inside the glass tubing.

The manufacture of acrylic plastics during World War II soon led to its wide introduction to the U.S. market after the war to an eager market place. Sign companies found and developed ways to craft channel letters with fashioned interior neon lighting and fitted acrylic plastic faces using a wide array of colors.

Fast Forward to the Computer Age

During the 1980s computer technology was introduced to the sign industry, making channel letter production much faster and less expensive—and that’s when neon really took off. Vendors manufacturing and selling components for neon found eager customers of neon transformers, electrodes, clear and coated sign tubing, as well a wide range of insulator parts and components. There was even an active business for vendors making neon manifold systems, some costing many thousands of dollars!

So, What Happened to Neon?

The early 1990s saw a new lighting technology introduced that eventually started to slowly erode the market dominance of neon. LEDs were being sold and manufacturers began to exhibit at industry trade shows and events. They were touting a lighting alternative to neon when installed in an enclosed channel letter, as well as illuminated colored border tubes. The early LED entrants were, by today’s standards, crude and not very bright—nor were they always consistent in color. However, the sign industry was interested and very receptive to this new technology, and sign guys encouraged the LED vendors to make brighter, better quality LEDs at ever-cheaper prices.

Challenges for Neon

While all this was developing, dark clouds were forming over the neon horizon and change would be coming in very dramatic fashion. The 1996 National Electric Code called out the requirement for secondary ground fault protection in Article 600. Although it would take another three years before Underwriter Laboratories would complete UL Standard 2161, and another two years to phase in the production of only new products, UL nonetheless issued a mandate to UL sign companies that they had to comply with UL 2161 in late 1999.

Another UL challenge around the same timeframe was UL’s effort to develop and implement UL Standard 879 for sign components and accessories. This was a huge burden imposed on many vendors of neon insulators and components, and many components disappeared as the cost to redesign, retool and resubmit could not be justified with neon volumes shrinking each year.

A third challenge came directly from the United States Environmental Protection Agency regarding the use of mercury in the workplace. The EPA along with several states attempted to either restrict or even eliminate mercury, an essential element in the production of both mercury argon tubes as well as fluorescent lamps. Several electrode manufacturers reacted by spending time and money researching, developing and marketing self-containing mercury electrodes; today only EGL offers this product, the rest are either out of business, out of that business or no longer promoting this type product.

Finally, the elimination of lead content in neon glass sign tubing by the glass vendors was a blow, and those making neon still feel the effects today. Now, each one of these various challenges by themselves should not have resulted in such dire consequences. So, imagine finding your company in the position of having to deal with all of these events one right after another. It can have a chilling effect on the future of one’s company, as well as an entire industry.

The Market Today

Most companies survived; some did not make it. As sales for neon signs continued to decline, many companies and vendors simply made a wholesale switch to LED products, and so doing continue serving their customers lighted sign demands with LEDs. Some neon sign companies have as their sales strategy building neon sign products that by their inherent nature do not lend themselves to LEDs easily. For example, they focus on neon border tubing, skeletal neon (exposed neon or possibly point-of-purchase neon signs), and would shy away from trying to offer neon in traditional channel letters unless their client insisted on neon. Other sign companies focus on a steady diet of cities and communities willing to spend money fixing up and restoring old, iconic neon signs.

I had the opportunity to interview the CEOs of two companies with long histories in the world of neon for this article: Mike Sweet, president of FMS Sign Products Division, and Henry Brown, president of Ventex Technology.

Mike Sweet, along with his brothers Greg and John, have been in business selling neon tubing, rare gases, neon electrodes and accessories for most of their adult lives. According to Mike, less than 10 percent of their annual sales volume is related to neon signs; the rest comes from their specialized metal finishing division.

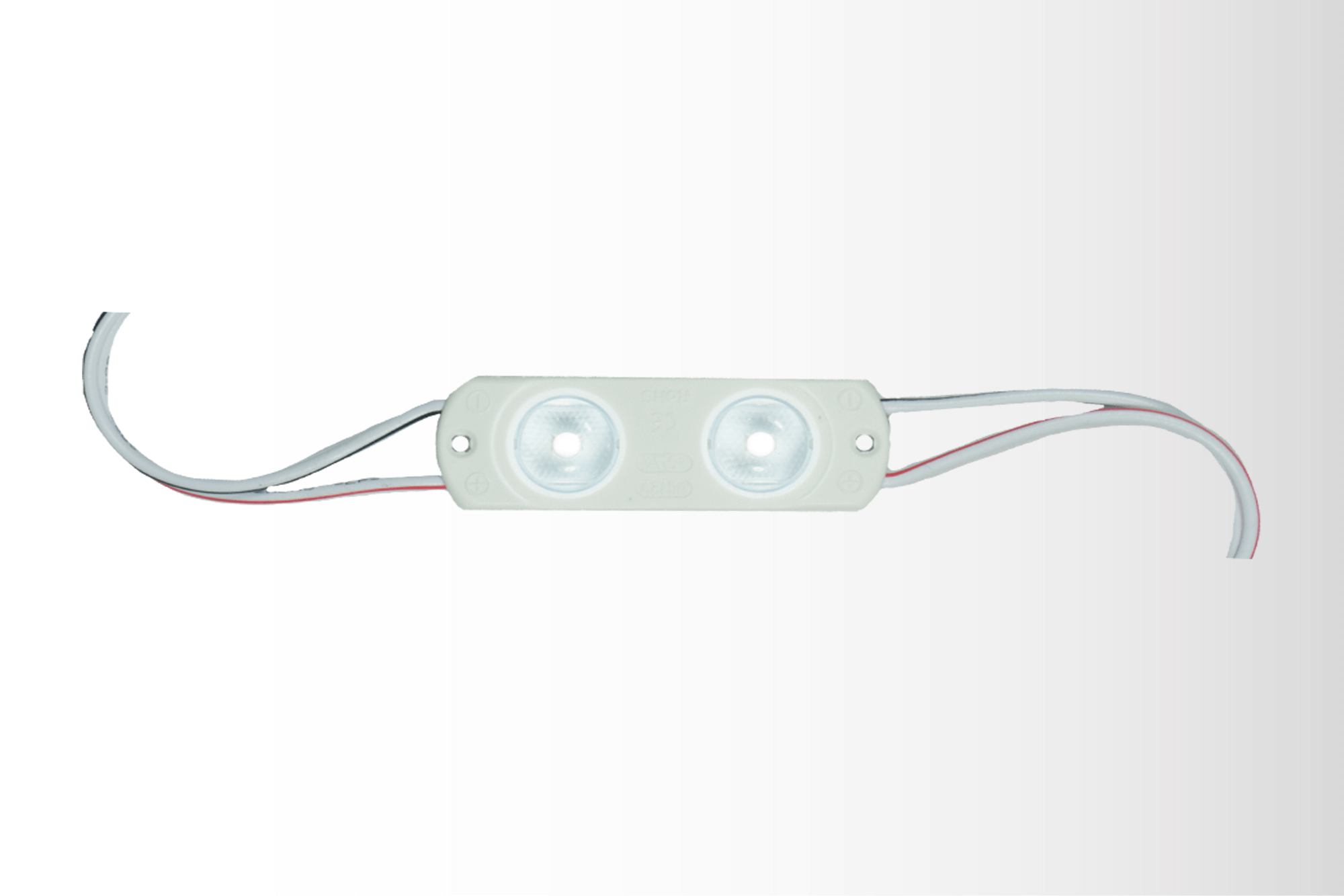

Ventex Technology LLC, which merged with Transco To Go in 2014, has a different market sales strategy to deal with the decline in neon. Ventex is a leading manufacturer and supplier of a comprehensive line of outdoor sign lighting using either neon or LED illumination. Roughly 80 percent of their annual sales volume is attributed to neon power supplies and other related neon components, where the rest is directed to LED sign products for the U.S. market. According to Brown, the company’s president, the firm is well positioned to serve the LED retrofit market for channel letters with their ‘’Rapid Retrofit’’ system, as well as competing in the fluorescent-to-LED sign cabinet retrofit market with their SNAPSTICKS product.

Challenges and Opportunities

If any market shrinks in size, the number of companies and products that serve that market shrink as well. Sadly, this holds true for the neon market today. For example, not too long ago there were three glass manufacturing plants producing neon glass sign tubing to serve this market. Today, there is only one left still producing neon tubing. Recently, the vendors still coating and supplying neon sign tubing were asked to place purchase orders that would represent their next six months’ glass needs. It was later reported that the glass factory was able to produce the combined needs of everyone in just four days.

Another area of concern not only for coated sign tubing but also the fluorescent lamp makers is a shrinking list of phosphor vendors. Fewer suppliers make it harder to source and find available raw materials, and at a cost needed to maintain stable pricing in the market.

Companies today are meeting these challenges in different ways by finding opportunities. For example, FMS decided to sell off its long-held flasher division because they didn’t feel it fit the business anymore, and they soon found a ready buyer. Other companies, like Ventex, saw an opportunity and plans to expand its electronic power supply product line to include Class 2, 12Vdc LED drivers, which will be introduced in the fall of 2015.

Closing

I asked Mike Sweet to take a peek into the future and tell me what he saw. His response: “I see more concerns than opportunities.’’ But he and his brothers are not afraid of change. For instance, they added online sales for sign tubing, electrodes, gas flasks and tube supports. Mike communicates daily with customers and he finds the whole experience interesting and fun. One bright spot he sees regarding today’s neon market—those working in the neon business are busy and passionate about what they do. It may be down, but don’t declare neon dead just yet.

This article was published in Sign & Digital Graphics Magazine on August 24, 2015.